who claims child on taxes with 50/50 custody texas

Under IRS tiebreaker rules theyd be entitled to claim the child as a dependent assuming your equal custody arrangement remains in place. In some cases divorced or unmarried.

Who Claims A Child On Taxes In Joint Custody

Who Claims a Child on Taxes With 5050 Custody.

. Typically when parents share 5050 custody they alternate. The parent with whom the child. Having a child may entitle you to certain deductions and credits on your yearly tax return.

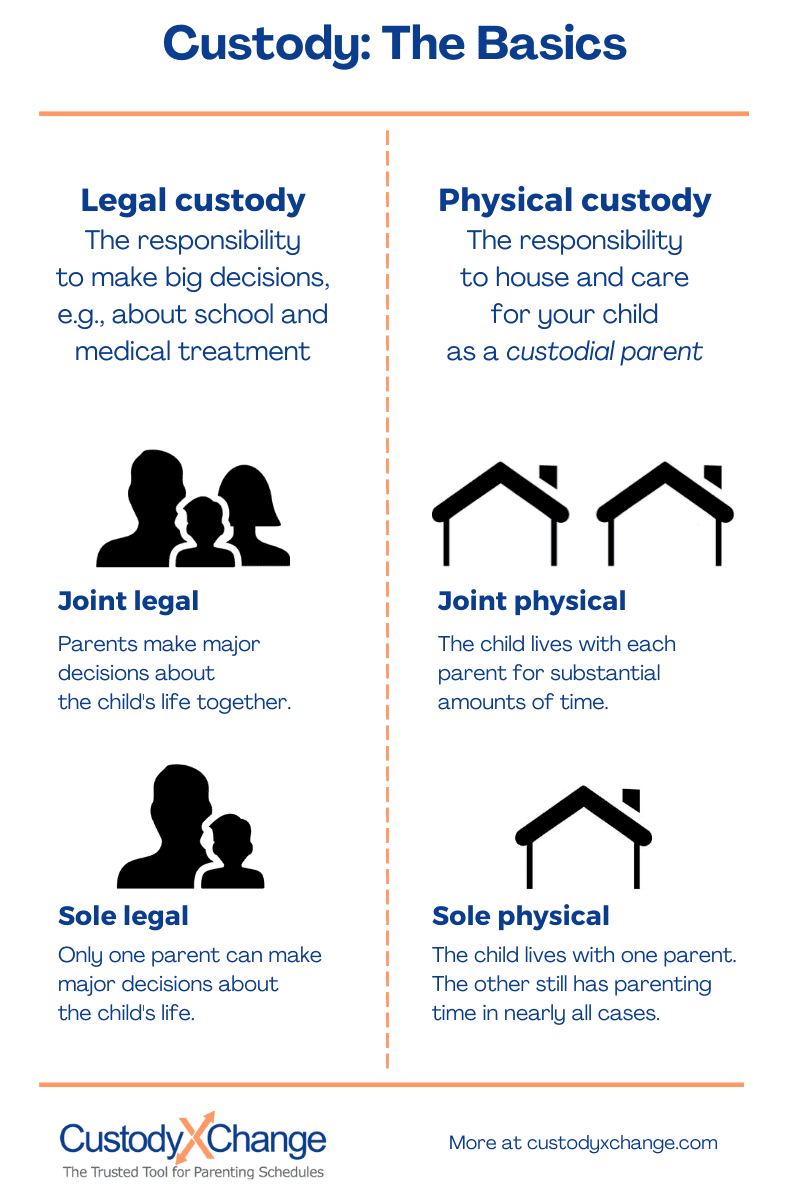

Parents Can Decide Who Will. Often in the case of 5050 custody and similar financial contribution from the parents the court orders that the parents take turns in claiming for the child. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

In other words the primary. Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. Who Claims the Child on Taxes With a 5050 Shared Custody Arrangement.

Who Claims the Child on Taxes With a 5050 Shared Custody Arrangement. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend. The chances of a father getting 5050 custody in Texas are far less if the child is under three years of age.

Who claims the minor child on their income tax in pennsylvania when the parents were never married and have a 5050 - Answered by a verified Tax Professional. However if the child custody agreement is 5050 the IRS allows the parent with the. Your childs age is also a factor in a physical custody determination.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. Who claims child on taxes with a 5050 custody split.

But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

But there is no option on tax forms for 5050 or joint custody. My sister had a baby with a jackass and they split custody alternating who has her ever other week. So one parent claims for the child.

Shared custody can create a situation where one parent gets to claim the child as a dependent. The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. In 2006 my old room.

Who Claims a Child on US Taxes With 5050 Custody. Who Claims a Child on Taxes With 5050 Custody. Who Claims the Child With 5050 Parenting Time.

The Internal Revenue Service IRS typically. According to the IRS rules the parent who has the child the majority of the time has a right to claim the child as their dependent when filing taxes. It is again important to understand that Texas.

Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be. It is again important to understand that Texas does not use the term custody in terms of making.

:max_bytes(150000):strip_icc()/114274370-56a870af3df78cf7729e1a2a.jpg)

Irs Tiebreaker Rules For Claiming Dependents

Family And Divorce Lawyer Frisco Tx Claiming A Child As A Dependent For Tax Purposes

Sole Legal Custody Defined Advantages Disadvantages

Site Search Law Office Of Bryan Fagan Pllc

Who Claims A Child On Us Taxes With 50 50 Custody

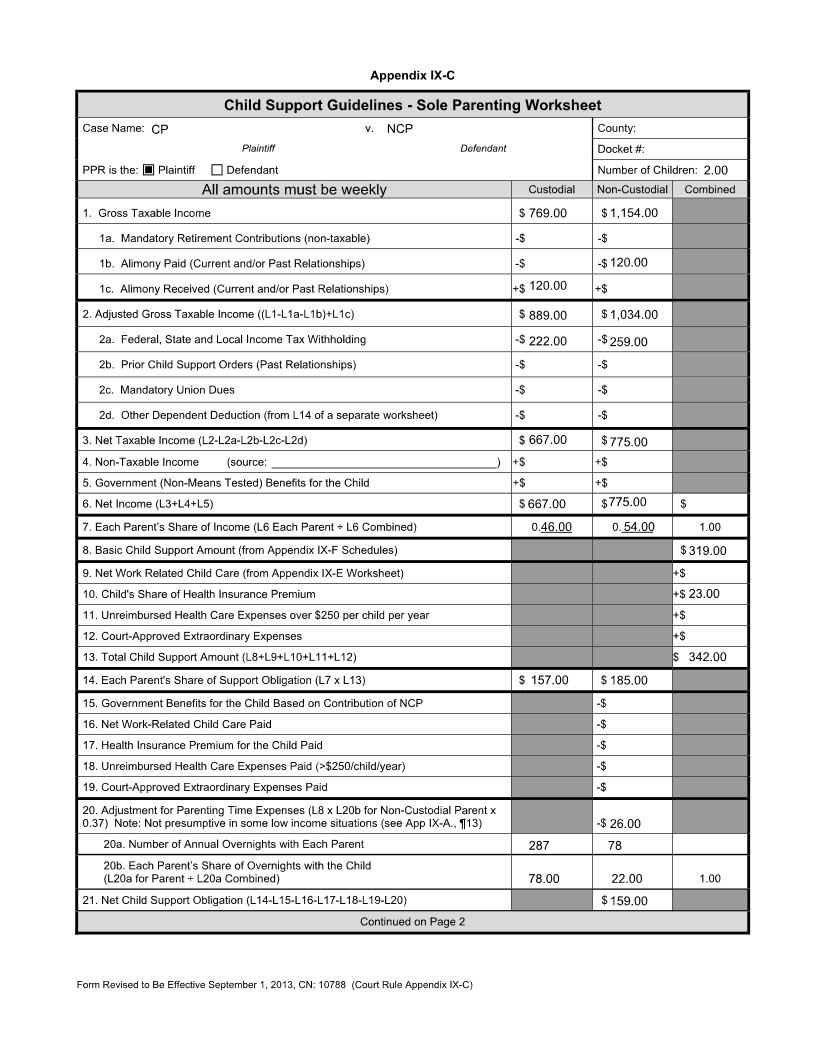

Child Support Guideline Models

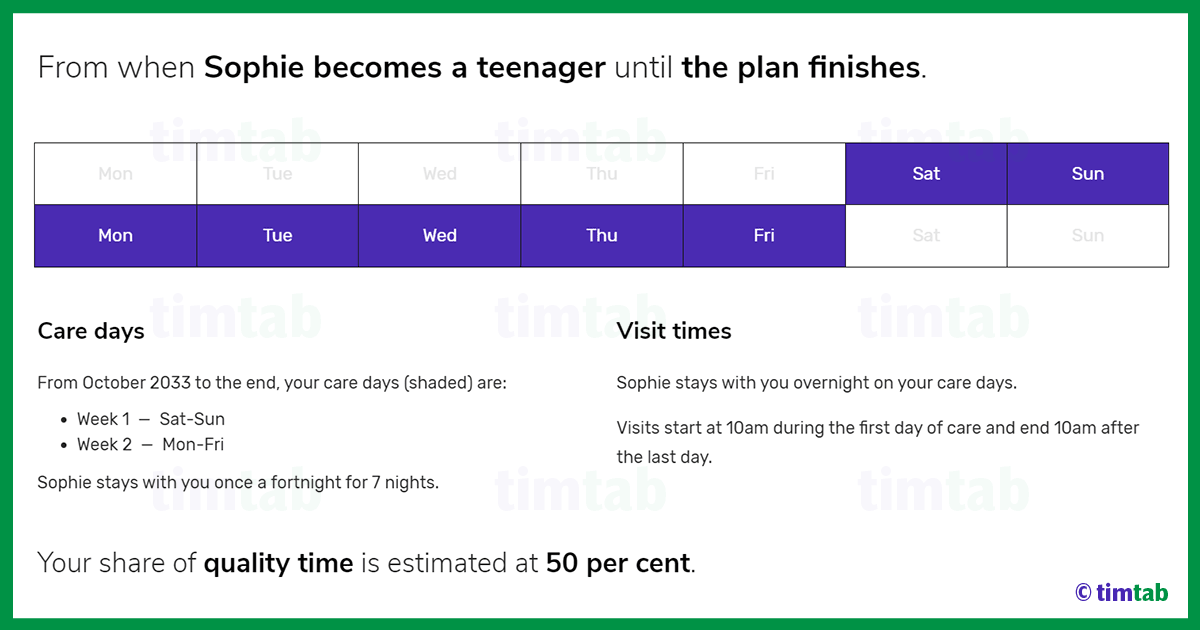

50 50 Custody Schedule In Texas Sisemore Law Firm

50 50 Custody Benefits Why Shared Parenting Is Important Timtab

Children S Rights In Texas Patriots For Parental Equality

Who Claims A Child On Taxes In Joint Custody

How Can The Father Get Full Custody Of The Children In Fort Worth Tx Law Office Wendy L Hart

Who Claims A Child In Joint Custody Lovetoknow

How Much Child Support Will I Pay In New Jersey

Child Support And Lower Incomes Texas Law Help

Should You Agree To A 50 50 Custody Split Youtube

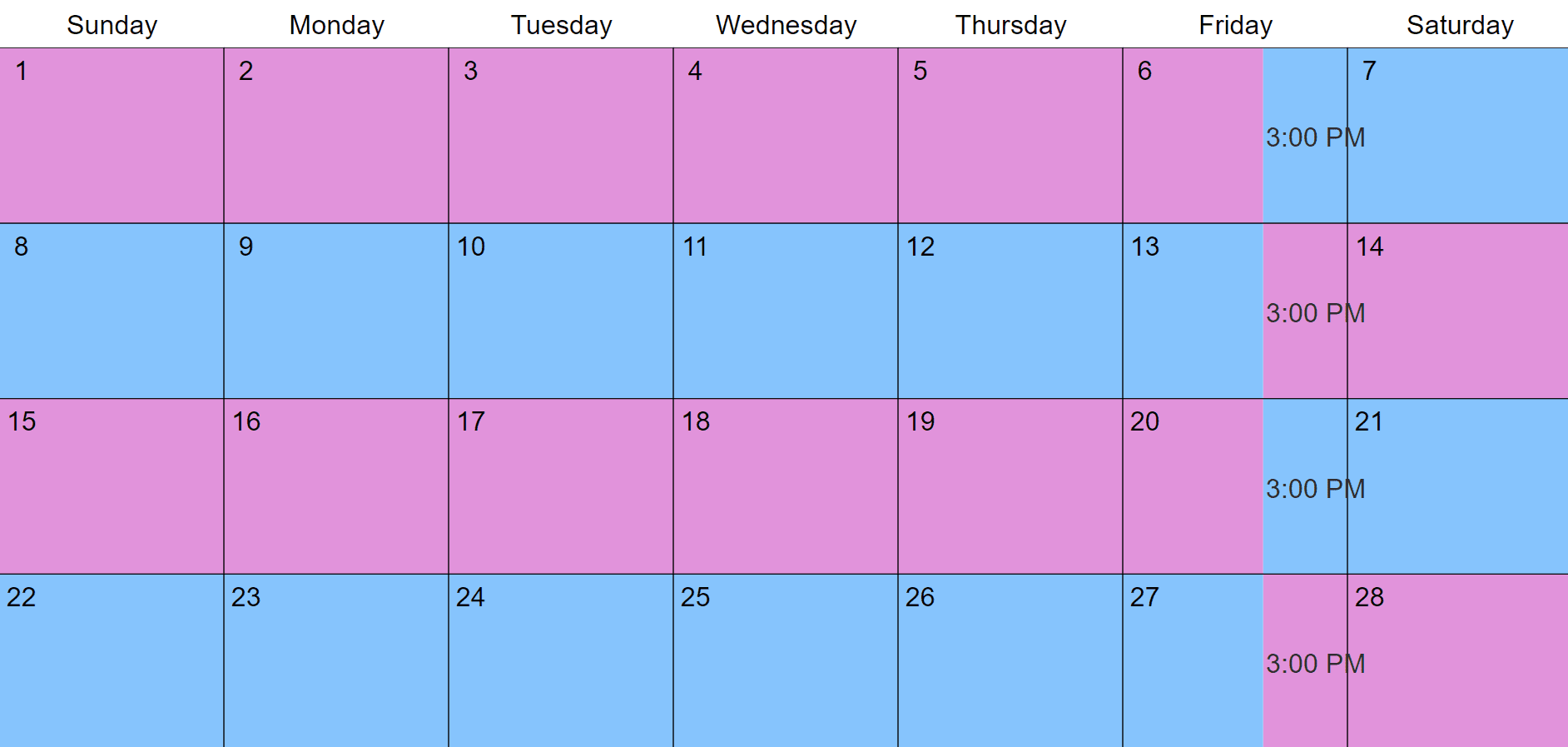

Alternating Weeks 50 50 Visitation 4 Example Schedules Pros Cons

Which Parent Claims The Children On Their Taxes After A Texas Divorce

Texas Trends Toward 50 50 Shared Custody Common Questions In Shared Custody Cases Attorney Kohm